Written by Yesenia Pineda

The debt ceiling is a factor that adds to both consumers and users on a global scale, however what does it mean when we hit the limit of borrowing to cover our already existing bills? What does it mean for the students who struggle?

To give a recap of the beginning of the new year, The United States has reached the limits of its borrowing allowance (aka borrowing amount which the federal government is LEGALLY allowed to use) for the coverage of bills that we have already. Not pre-existing, not ones in the drafting stage that goes through congress review, these are already signed and approved congress bills that we have set in motion.

So what does the debt ceiling mean in exact terms of money or how much debt the United States has racked up?

As the Treasury of the United States, Janet Yellen, has looked over the onslaught of rising debt within her time in office and the total amount of debt the United States has risen is nothing short of a matter needing addressing. As of the 19th of January 2023, the U.S.A’s debt has reached a whopping total of 31.4 trillion dollars in allowable debt.

Yes, that number is correct.

31.4 trillion dollars worth of already signed and existing bills is the amount of debt the U.S.A has reached as of the new year. Now the debt is categorized in two factors as it is also a political debate between both Republicans and Democrats parties alike. The first factor being how much the federal government has spent to cover the bills we have, meaning all the news you see about the congress debating bills to pass on for presidential signature is that. The second factor is the national debt we have.

The national debt is how much the United States pays in interest and various security interest rates to keep the country afloat in regards to everything we consume and use. Now, as we have a total of 31.4 trillion dollars of debt you may be wondering how much it costs to pay national debt? Here are the numbers you need to know, as of December 2022 it takes $210 billion dollars to maintain the debt where it is now, yet that is 15% of the total federal government spending and there’s more than just that percentage.

The scary part of this percentage rate is that it increases by the year. Meaning, everything gets a bit pricey, common goods become more expensive, imports have a higher tariff and finally essential goods become harder to have. (yes, eggs are in that factor especially coming from supermarkets trying to stay afloat with customer demands.)

Now as we reached the debt ceiling what could this mean for workers and life. It means a higher inflation for the working and middle class groups of society, including those who need government assistance. While yes, “extreme measures” have been taken to prevent such chaos and disorder by the United States treasury, Janet Yellen, these measures will only last until June until the actions of congress affect the society underneath them.

(courtesy of NBC news, video here)

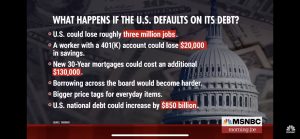

Should the worst absolutely happen, aka defaulting on the debt we have, dire consequences would be in store for many in our society especially students with student loans. If the United States defaults millions and millions of Americans and thousands of companies will suffer and could lead into a recession or if worse case a turndown that is already expected.

As for students, there’s various factors in play like President Biden’s student loan forgiveness and rising students taking out loans. Now the United States hasn’t defaulted on its debt, it has lapsed since the 1970’s but there was never a missed payment or a default.

So what exactly does this mean for students and the future of their studies in community colleges, four-year institutes and universities all across the united states?

Like the factors I’ve stated prior, the results for students could result in loans not being paid out to them even worse for those who receive grants (or student aide) won’t have their fees covered in a generous amount of time which could lead to a freeze suspending their accounts. However, those who already had their loans forgiven via president Biden’s forgiveness will see a change rising, yet for those who are rising students monitoring your student loans and grants will become a huge necessity.

As Lisa Remillard, two time Emmy award nominee journalist mentions within this TikTok (video link) that much of these situations all interlock with how the United States wishes to address the crisis that is the debt ceiling.

With the debt ceiling and student loans, many students are caught in the crossfires of what to do when worse turns into absolute chaos. The debt ceiling can cause students to have frozen payment plans, suspended loan payment to their school balances, and worse a freeze on financial aid as it comes from government aid based payment plans.

So for students, the consequences are a lot higher when we consider the fact that colleges, universities and four year institutes are all government based occupations because they all function on government funding.

For many students within the united states more precisely for us in Maryland, they rely on the FAFSA (Free Application For Federal Student Aid) and MDCAPS (Maryland College Aid Processing System) to help get government aid, funding or grants, so with the heavy inclusion of a debt ceiling crisis everything that a student holds dear about going on for higher education can be jeopardized should nothing concrete be made to solve the issue about the debt ceiling.

Within a grand majority, many rely on subsidized and unsubsidized federal loans and scholarships given to them from the school they attend to receive the education that comes with going to college. However, between getting the loans and getting loan forgiveness many students continue to be in limbo because the clock keeps ticking with how the senate wishes to really evaluate the situation both Republicans and Democrats continue to debate on with urgency.

Everyone is impacted by the matters of the debt ceiling, but all students are the ones who are in limbo because of the fear of not having something to cover the costs of their college bill on their personal student accounts.

The debt ceiling is serious but it’s so important for the rising generation of college students to have this matter taken care of before June 1st before everything changes in the most impactful time in United States history regarding our debt.